User Guide

Overview on Business Case

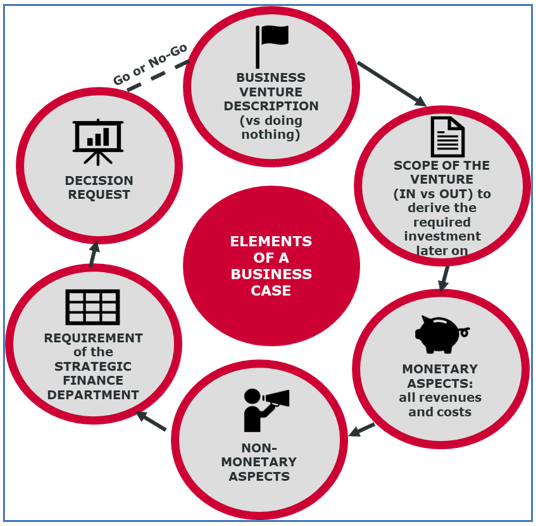

A Business Case describes the advantages and disadvantages of a business venture versus doing nothing. The people working on a Business Case aim to get the decision of stakeholders, to pursue the venture or not.

A Business Case consists of qualitative or non-monetary aspects (like strategic fit or reputation) as well as quantitative or monetary aspects (like NPV or payback period). In a decision request to stakeholders, both aspects should be considered.

Overview on Business Case tool

Our tool aims to support effective decision making for the monetary aspects of a Business Case, by applying a simple standard with two Key Performance Indicators (KPIs): Net Present Value and Payback Period. Furthermore it reveals some effects of an isolated investment decision on the financial statement of a firm (.g. impact of the investment decision on the Net operating profit after tax) as well as on its liquidity (early Cash In and Cash Out).

Key Components of a Business Case

In academic teaching (Finance) as well as in daily business, two KPIs have been evolving as standard to evaluate the monetary benefits of an investment decision:

- Net Present Value Calculation (NPV):

- Payback Period (PYP):

The “Net present value” (NPV) is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. It is used in capital budgeting and investment planning to analyze the profitability of a projected investment or project. As a general guideline, projects with a positive NPV could be accepted.

Payback period in capital budgeting refers to the period of time required to pay back an initial investment. Many industries require a payback period below 5 years.

Consileon's Business Case Calculator (CBCC)

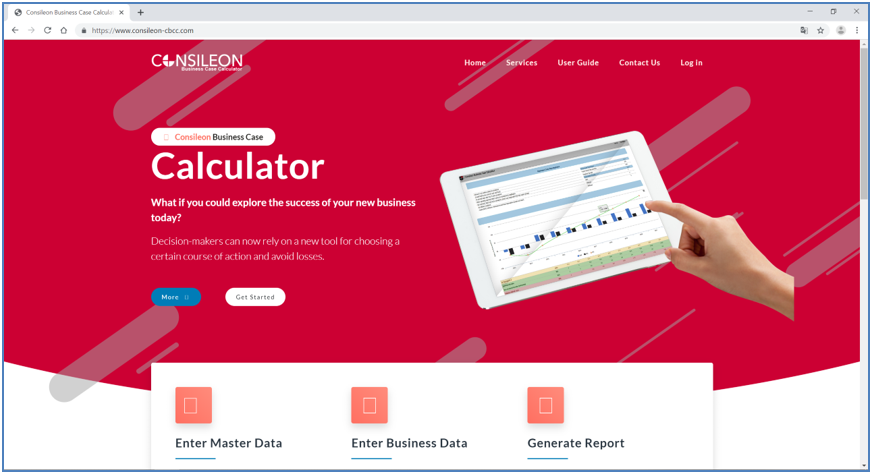

Consileon's Business Case Calculator (CBCC) is an easy-to-use online tool. The tool is based on a standard methodology, which allows comparison between several Business Cases of a firm. The CBCC is accessible via any browser under https://www.business-case-calculator.com/ and the tool offers the following advantages:

- Web-based solution, accessible anytime from everywhere

- Quick user registration (also anonymously if desired)

- Easy to use GUI

- Archiving of Business Cases and versions

- Standard reporting and download of Business Case results

- Standard version can be used free of charge

Point of Contact

In case, if there are any technical or functional queries, the user can use the following email address for requests: info@business-case-calculator.com.

For any inquiries, we try to get back to you within 24 hours (please note that no standard services are available during public holidays or weekends (Germany).

In case you need advanced service levels, or if you wish to customize the methodology or the tool according to your firm internal standards, please contact us under above email address, too.

The CBCC tool validates the user input on field level, and displays information or warning messages immediately when required.

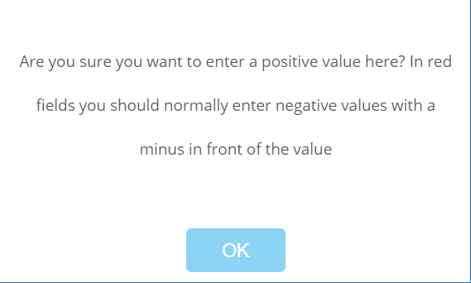

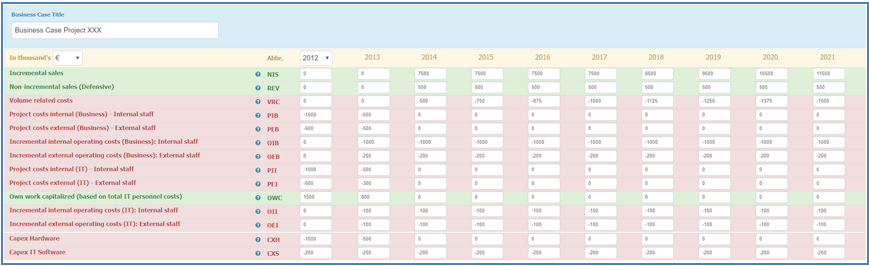

By default, the users are expected to enter positive values in the green colored rows (for e.g., Incremental Sales) and negative values (have to be prefixed by minus symbol) in the red colored rows (for e.g., Project costs internal). However, the user is allowed to ignore warning messages of the tool, and can enter negative values in the green colored input rows or positive values in the red colored input rows.

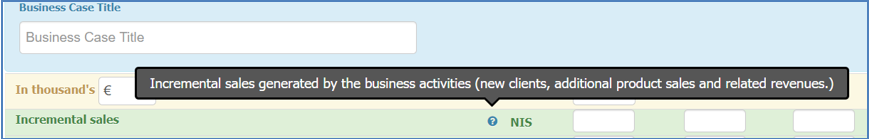

Additionally, each row has a short explanation of the respective business term and the formulas applied in the tool if applicable. The user has to click the help symbol (?) to view the short explanation.

For normal and self-activated users, the CBCC tool supports a flat user structure, meaning that there is only one user level, through which the user can:

- Create a new business case

- View an existing business case

- Modify an existing business case

- Export an existing business case into a PDF format

- For a customized version of the tool, also a “global admin user” can be supported

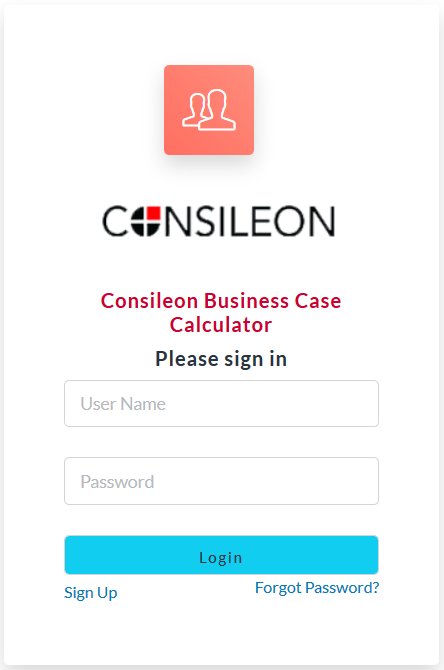

Sign Up/Logging On

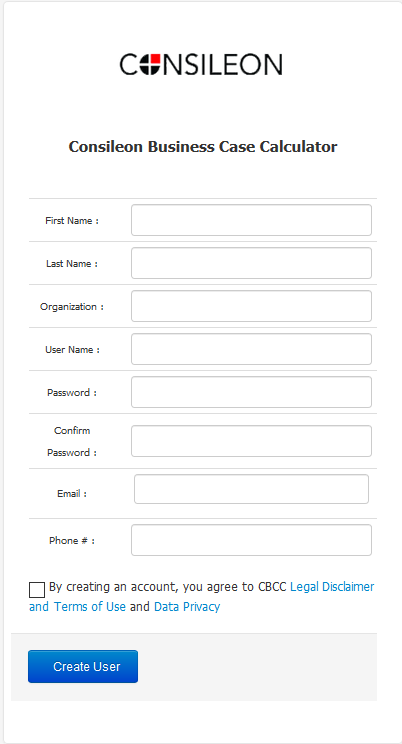

The user can create a login id using the "Sign Up" option available in the main screen on the left bottom (after clicking on “Log in” on the main homepage).

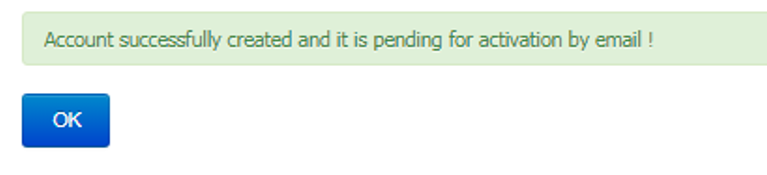

Activating User:

In order to activate the user, the user shall click on the "activation link" present in the mail with the subject "Verify Your Email Address". In case, if the user forgot the password for the tool, the "Forgot password?" option can be used to setup a new password.

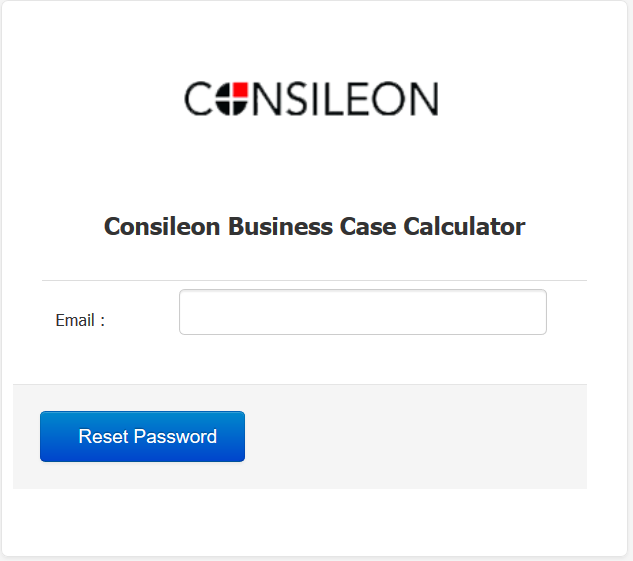

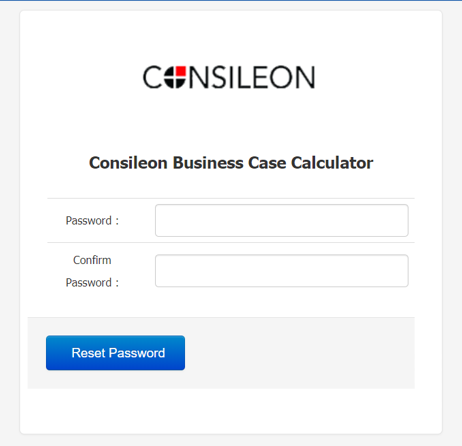

The user must enter the same email-id which was entered while creating the login id. After entering the valid email-id, the user shall click on the "Reset Password" button.

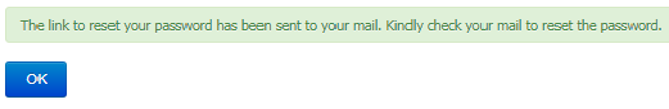

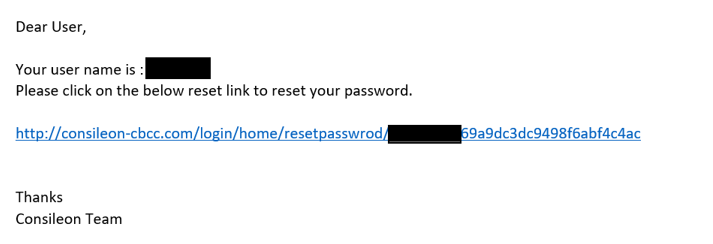

Now, the user would receive an email with the subject "Reset Password" which has the name of the user and the link to reset the password. The user shall click the link in the email and enter the new password:

The user can set a new password:

Exit System:

The user shall logout via the button at the top right and close the respective browser or the browser window to close the tool.

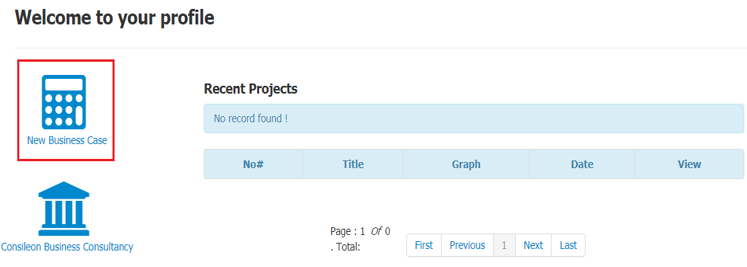

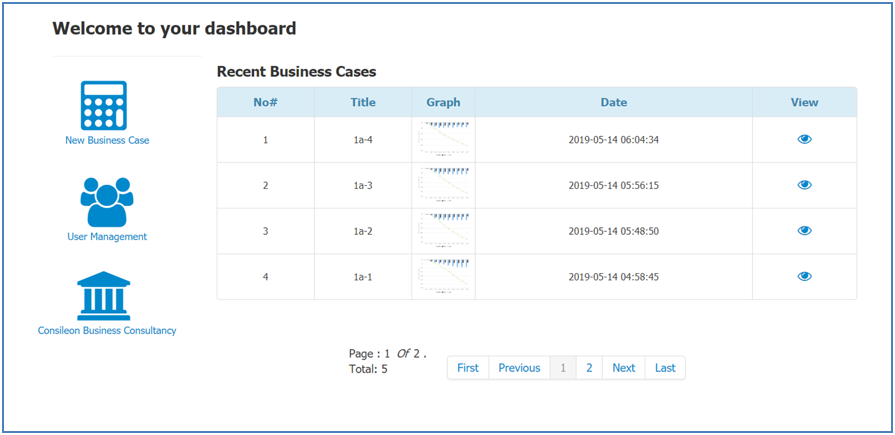

After the successful login, the user can create a new business case or select one of the previous business cases. Click on the link "New Business Case" to create a new case. Below screenshot shows the highlighted link in red color.

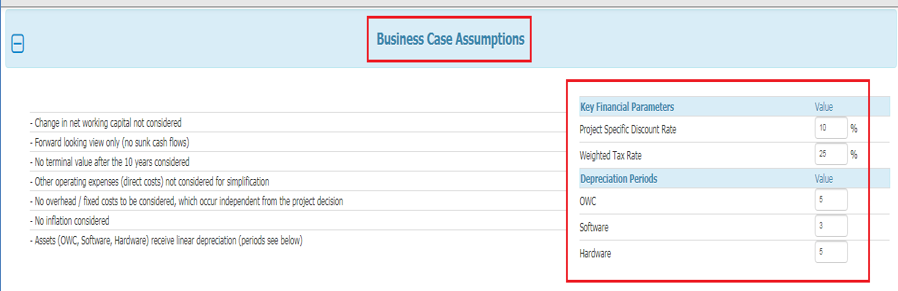

After the user clicks the "New Business Case", the below screen will be displayed to the user.

The user must enter a unique business case title which is mandatory. The user can use alphabets, numbers or special characters or a combination of all for the title. This business case title would be saved by the tool in case if the user wants to view/edit the business case later in the future.

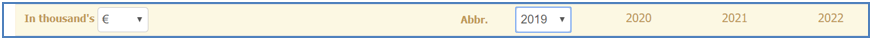

After choosing a title, you can select between two currencies, EURO and US-Dollar.

Right next to it, you must select the starting year of your business case calculation, the following years will be added automatically:

The following columns must be filled with the data for your business case. For an easier orientation, green fields should contain positive values, red ones negative values; for this, please use the minus symbol (“-“), otherwise you will receive the following error message:

As mentioned above, clicking on the question mark symbol will open a context help menu.

The screenshot below shows a fully completed business case:

When you want to modify an existing business case, you can click on the “Edit” button at the bottom of the page:

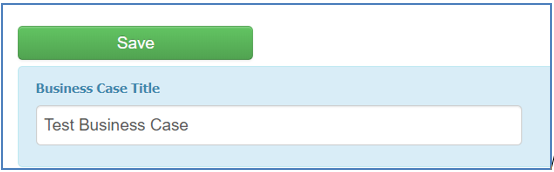

Then you will be re-directed to a mode where you can change the values again. Don’t forget to save the changes by clicking on the save button at the top:

A user can only access the business cases that have been created by her/himself and which can be found in their dashboards after logging in:

In the view section of a single business case created by users, it is possible to download a report at the bottom of the page by clicking on the button “PDF report”

| Term | Definition / Explanation |

|---|---|

| Incremental Sales | Incremental sales generated by business activity (new clients, additional product sales and related revenues, …). |

| Non-Incremental Sales (Defensive) | Loss of revenues that has been avoided because the project investment has been undertaken. Avoid arguing with NonIncremental Sales if possible (difficult to track and to proof). |

| Volume Related Costs | Cost that occur because of incremental and non-incremental sales have been generated (e.g. external costs like depositary fees). Normally a ratio related to both Sales components. |

| Own Work Capitalized | Some costs can be capitalized and have therefore a positive effect on income statement (e.g. in Germany IT development costs in form of personnel costs can be capitalized). OWC is depreciated. |

| Project Costs Business | Mainly consider internal and external staff costs. Apply standard hourly or daily rates for personnel to come up with EUR values |

| Incremental Operating Costs Business | Mainly consider internal and external staff costs for additional operations (manual procedures etc.). Normally consider yearly gross salary of additional personnel. |

| Project Costs IT | Mainly consider internal and external staff costs. Apply standard hourly or daily rates for personnel to come up with EUR values. |

| Incremental Operating Costs IT | Mainly consider internal and external staff costs for additional operations (production support, additional maintenance costs, etc). Normally consider yearly gross salary of additional personnel. |

| Depreciation | Depreciation of hardware, software and OWC. Please refer to worksheet “depreciation (don’t edit)”. Those should be negative amounts. |

| Earnings Before Tax | Sum of revenues and OWC, minus VRC, minus project and operating expenses and minus sum of all depreciations. |

| Income Tax | Corporate Tax Rate for a specific country or weighted tax rate across countries is used to calculate income tax. For the tax rate see sheet “assumptions and parameters”. |

| Net Operating Profit after tax | Earnings before Tax minus Income Tax |

| CAPEX Hardware | CAPEX comprises all investments in software, hardware and other assets that are purchased externally and which can be depreciated. Here: Hardware investments. |

| CAPEX Software | CAPEX comprises all investments in software, hardware and other assets that are purchased externally and which can be depreciated. Here: Software investments like license costs. |

| Free Cash Flow (FCF) | Represents cash flow per year from the project and is used for DCF calculation. To determine the Free Cash Flow, depreciations and OWC must be used with opposite values (to determine cash impact of those components). CAPEX has to be considered in the cash flow determination, too. |

| Cash In | Expresses total cash revenues generated by the project (incremental and non-incremental) whereby non-cash revenue items such as OWC are not reflected. Tax effects and changes in net working capital are excluded. |

| Cash Out | Shows total expenditures of the project including total volume related costs, total operating costs, and CAPEX (IT and Business). Tax effects and changes in net working capital are excluded. |

Following you can download the User Guide in PDF version